What it Means for Commercial Property Owners

If you own a commercial property, a warehouse, a manufacturing space, or a high-energy data center, you’re probably more focused on your core business than the play-by-play of the Inflation Reduction Act (the Act) recently signed into law. We have combed through the coverage and bill to summarize the key components that will have an impact on your business when considering solar power for your property.

First off, the disclaimers: Infiniti Energy does not offer tax advice. Consult with your tax advisors to understand your specific situation. There is a lot to unpack in the new bill. Final interpretations of the act may vary from the information provided below. We have provided the best information we can as of this writing, so check back often for further details.

Incentives for Solar

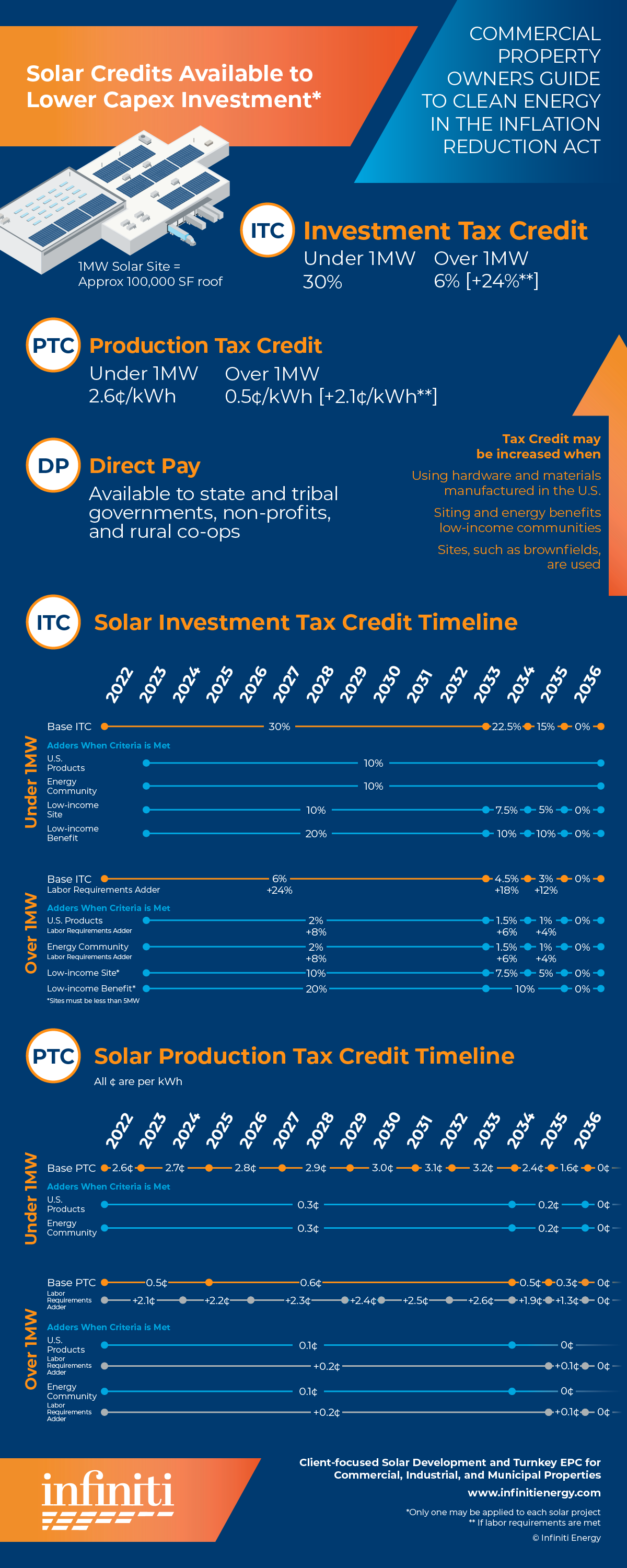

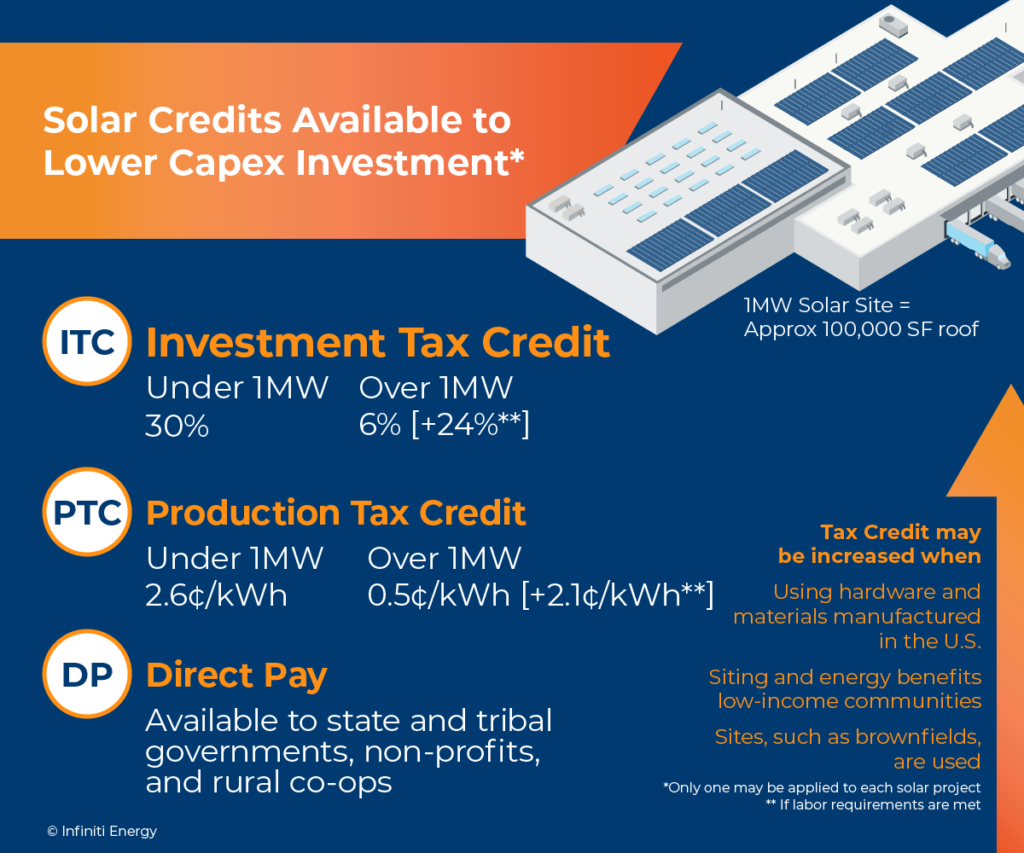

The Act provides three paths for incentives that will lower your capex investment, whether you choose to own your solar asset or enter into a power purchase agreement (PPA). Which incentive makes the most sense for you is dependent on your location and situation. However, only one credit may be chosen for each solar site.

The Act provides three paths for incentives that will lower your capex investment, whether you choose to own your solar asset or enter into a power purchase agreement (PPA). Which incentive makes the most sense for you is dependent on your location and situation. However, only one credit may be chosen for each solar site.

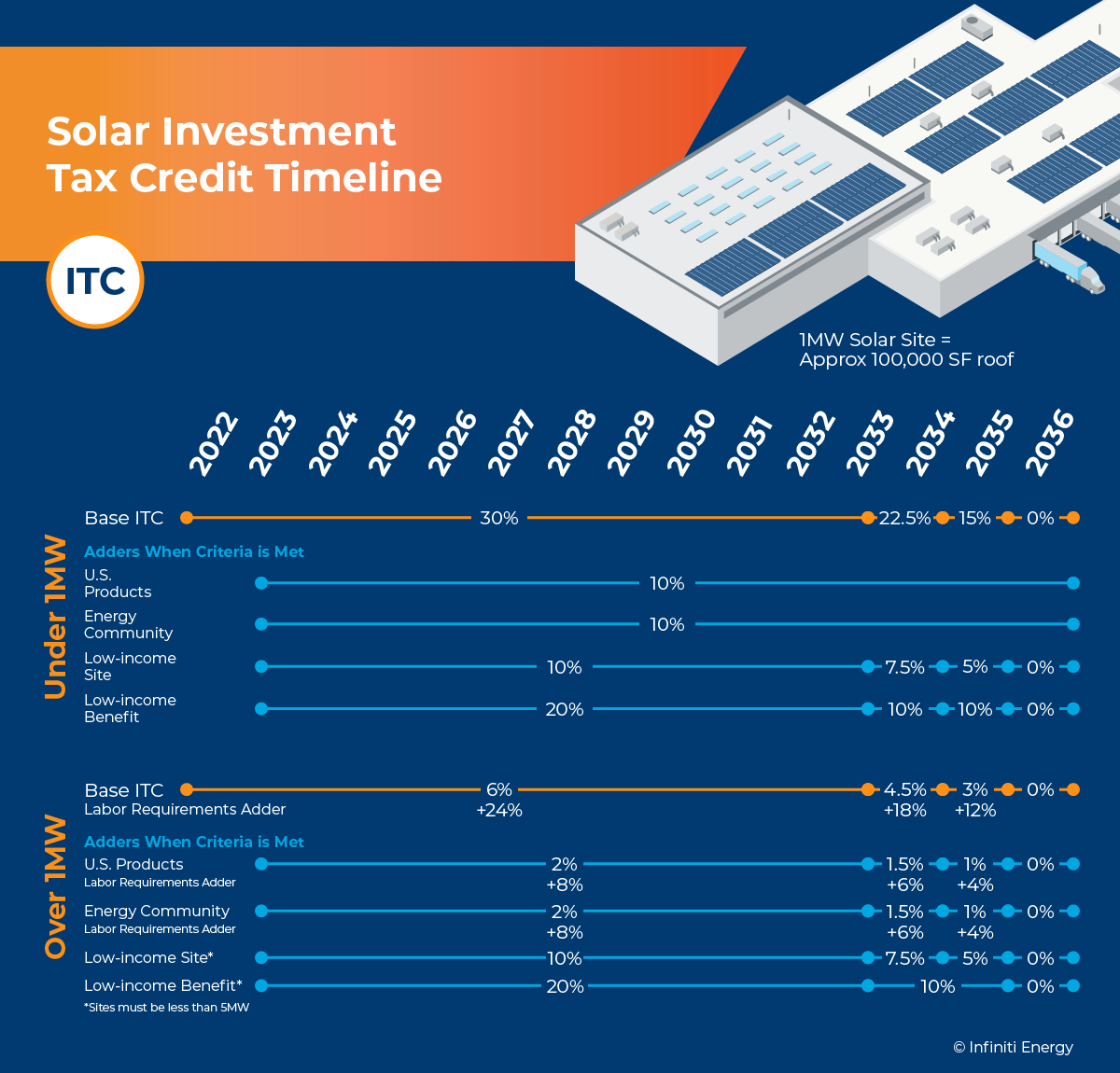

Investment Tax Credit (ITC)

The ITC is an incentive lowering your overall investment in the form of a tax credit. If you own your solar asset, you can take advantage of the ITC. Prior to the Act, the ITC for solar projects was 26% in 2022, dropping significantly in 2023 and beyond. The Act offers commercial property owners a more generous credit through 2033.

If the total solar site is under 1 MW – approximately 100,000 sq. ft. roof – a 30% ITC is available. For larger projects, the ITC is also 30% if certain labor requirements are met. If they aren’t met, the incentive for solar assets over 1 MW is 6%.

In addition to a 30% ITC base, additional benefits may be available if solar projects utilize hardware and materials manufactured in the U.S., and if siting and energy benefits low-income communities. If ALL criteria are met, the ITC can be as high as 70%.

With the passage of this bill, American manufacturers are either re-shoring production or ramping up new production facilities to meet the expected demand. We urge you to reach out if interested in going solar as U.S.-based materials may quickly be in short supply. It could take several years for U.S.-based production to fully meet demand.

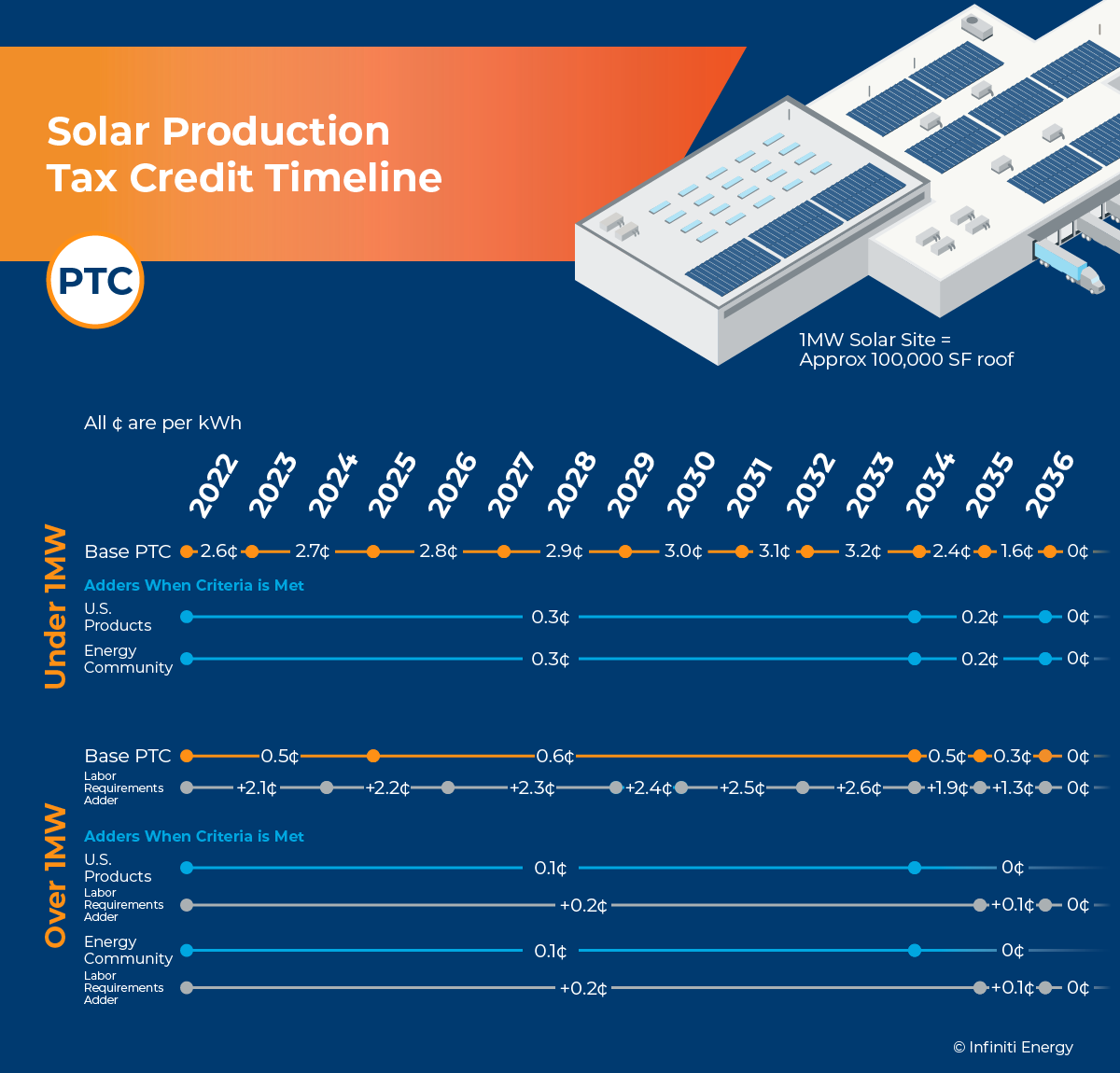

Production Tax Credit (PTC)

The PTC is an incentive based on a facility’s greenhouse gas emissions rate (GGER) and the clean energy produced. Requirements must be met for “tech-neutral” zero emissions in order to take advantage of the PTC. The PTC incentivizes solar energy (kWh) produced.

Assuming GGER criteria are met, the PTC provides 2.6¢/kWh for solar sites under 1 MW in 2022, increasing to 3.2¢/kWh in 2032. For sites over 1 MW, if certain labor requirements are met, rates start at 2.1¢/kWh in 2022, rising to 2.6¢/kWh in 2032 .

Like the ITC, the PTC offers additional benefits for solar sites that meet labor requirements for prevailing wages and apprenticeships, use mostly U.S.-made products, and help low-income communities.

Direct Pay

The Direct Pay option is limited to state and tribal governments, Alaska native corporations, non-profit entities, and rural cooperatives. Direct Pay will provide benefits for solar project installs to organizations who have not been able to take advantage of the ITC since they don’t pay taxes. Most commercial properties will not be able to take advantage of this option.

Timeline for Credits

When do current incentives expire and new incentives go into effect? Projects beginning construction after 2019 and placed in service before January 1, 2022 will receive current ITC incentives of 26%. No PTC or Direct Pay is available.

Projects Under 1MW

ITC

| Project begins construction | Base ITC | Domestic content minimums met, add | Siting in “Energy Community”, add | Siting in low-income community, add | Qualified low-income benefit project, add |

| 2022 | 30% | – | – | – | – |

| 2023-2033 | 30% | 10% | 10% | 10% | 20% |

| 2034 | 22.5% | 10% | 10% | 7.5% | 10% |

| 2035 | 15% | 10% | 10% | 5% | 10% |

| 2036 | 0% | 10% | 10% | 0% | 0% |

PTC

All pricing is per kWh

| Project begins construction | Base ITC | Domestic content minimums met, add | Siting in “Energy Community”, add |

| 2022 | 2.6¢ | 0.3¢ | 0.3¢ |

| 2023-2024 | 2.7¢ | 0.3¢ | 0.3¢ |

| 2025-2026 | 2.8¢ | 0.3¢ | 0.3¢ |

| 2027-2028 | 2.9¢ | 0.3¢ | 0.3¢ |

| 2029-2030 | 3.0¢ | 0.3¢ | 0.3¢ |

| 2031 | 3.1¢ | 0.3¢ | 0.3¢ |

| 2032-2033 | 3.2¢ | 0.3¢ | 0.3¢ |

| 2034 | 2.4¢ | 0.2¢ | 0.2¢ |

| 2035 | 1.6¢ | 0.2¢ | 0.2¢ |

| 2036 | 0¢ | 0¢ | 0¢ |

Projects Over 1MW

ITC

| Project begins construction | Base ITC | Meet labor requirements, add |

Domestic content minimums met, add |

Siting in “Energy Community”, add [Labor req’s not met | Labor req’s met] |

Under 5MW and siting in low-income community, add |

Under 5MW and qualified low-income benefit project, add |

| 2022 | 6% | 24% | – | – | – | – |

| 2023-2033 | 6% | 24% | 2% | 8% | 2% | 8% | 10% | 2% | 8% |

| 2034 | 4.5% | 18% | 1.5% | 6% | 1.5% | 6% | 7.5% | 10% |

| 2035 | 3% | 12% | 1% | 4% | 1% | 4% | 5% | 10% |

| 2036 | 0% | 0% | 0% | 0% | 0% | 0% |

PTC

All pricing is per kWh

| Project begins construction | Base ITC | Meet labor requirements, add | Domestic content minimums met, add [Labor req’s not met | Labor req’s met] |

Siting in “Energy Community”, add [Labor req’s not met | Labor req’s met] |

| 2022-2023 | 0.5¢ | 2.1¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2024 | 0.5¢ | 2.2¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2025 | 0.6¢ | 2.2¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2026-2028 | 0.6¢ | 2.3¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2029 | 0.6¢ | 2.4¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2030-2031 | 0.6¢ | 2.5¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2032-2033 | 0.6¢ | 2.6¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2034 | 0.5¢ | 1.9¢ | 0.1¢ | 0.2¢ | 0.1¢ | 0.2¢ |

| 2035 | 0.3¢ | 1.3¢ | 0.0¢ | 0.1¢ | 0.0¢ | 0.1¢ |

| 2036 | 0¢ | 0¢ | 0¢ | 0¢ |

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Solar and Beyond

While we have talked about the Act as it relates to solar to this point, solar is not the only clean energy technology covered. For the first time, the ITC will also cover energy storage. Incentives will be available to build out electric vehicle charging networks. Excellent news for those of you with parking facilities. And transmission and interconnection grants and loans will be available, which is good news for those of you who are thinking about leasing roofs or land for community solar.